By Tashi McQueen

AFRO Political Writer

tmcqueen@afro.com

The U.S. Supreme Court officially blocked Biden’s Student Debt Relief Plan on June 30.

Applications for the Biden-Harris loan forgiveness program opened in October 2022. It was created to “help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires,” according to the U.S. Department of Education.

“A day after the Supreme Court stuck a knife in the back of Black America, a majority of justices have now cut the ladder out from under us,” said Rev. Al Sharpton, founder of the National Action Network, in a statement released by the civil and human rights organization. “Generations of Black youth were sold a bill of goods that higher education was a pathway out of poverty – only to be saddled with crushing debt that never lets them see their dreams fully realized.”

“President Biden’s relief plan would have provided a little help for millions caught up in this broken promise,” continued Sharpton. “Now, the Supreme Court has ruled even a mere $10,000 is too much, especially when the average Black college graduate owes well over $50,000.”

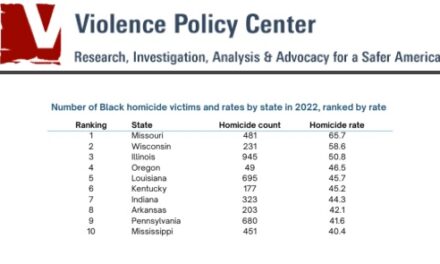

As of 2023, there are 43.6 million people who have federal student loan debt, according to the Education Debt Initiative. Black student borrowers owe $25,000 more than White debtors owe for bachelor’s degrees.

“For too long, our nation’s student debt crisis has disproportionately impacted Black Americans—particularly Black women—due to discriminatory policies that have denied us the opportunity to build generational wealth,” said Rep. Ayanna Pressley (D-MA-07) and Congressional Black Caucus Chairman Steven Horsford (D-NV-04) in a joint public statement. “We applauded President Biden when he took historic action to cancel student debt. Today, he must follow through on his promise and act swiftly and decisively to deliver this transformative relief. Our communities have waited long enough.”

The program would have provided relief of up to $20,000 for Pell Grant recipients, an aid for students in financial need. Borrowers were eligible if their individual income was less than $125,000 and for households with less than $250,000.

“Black students disproportionately depend on student loans to go to college and are three times as likely to default on student debt,” D.C. Councilwoman Janeese Lewis George (D-Ward 4) tweeted. “The U.S. Supreme Court enforces affirmative action for the rich, privileged and powerful — but bootstraps and bankruptcy for Black students in America.”

According to data released by the White House in January, 26 million people applied for the program and 16 million of those applications were approved and sent to loan servicers.

A federal appeals court in Missouri blocked the program in November 2022 due to a challenge by Nebraska and five other states. According to the application website, all submitted applications were held pending the court’s decision.

“Student loan relief is a promise from President Biden to more than 40 million families. It is our chance for dignity. He must immediately implement a plan B, including finding a different path to ensure no repayment begins until cancellation is delivered,” said Melissa Byrne, student loan activist and executive director of We The 45 Million. “Failure to deliver student loan relief is not an option.”

Student loan repayment will resume in October and student loan interest will once again begin to accrue on Sept. 1, 2023, according to the U.S. Department of Education.

Tashi McQueen is a Report For America Corps Member.

#politics #ussupremecourt #studentloans #biden

NOT FOR PRINT

Supreme-court-decision-on-student-loan-forgiveness-expected-friday.html

Student-loan-forgiveness-appeals-court-stay-what-you-should-do

court-will-review-legality-of-bidens-student-debt-relief-but-plan-remains-on-hold-for-now

These-6-student-loan-forgiveness-avenues-are-not-blocked-by-the-supreme-court

The-supreme-court-takes-up-student-loan-forgiveness-whats-at-stake

The post U.S. Supreme Court strikes down Biden’s Student Debt Relief Plan appeared first on AFRO American Newspapers .