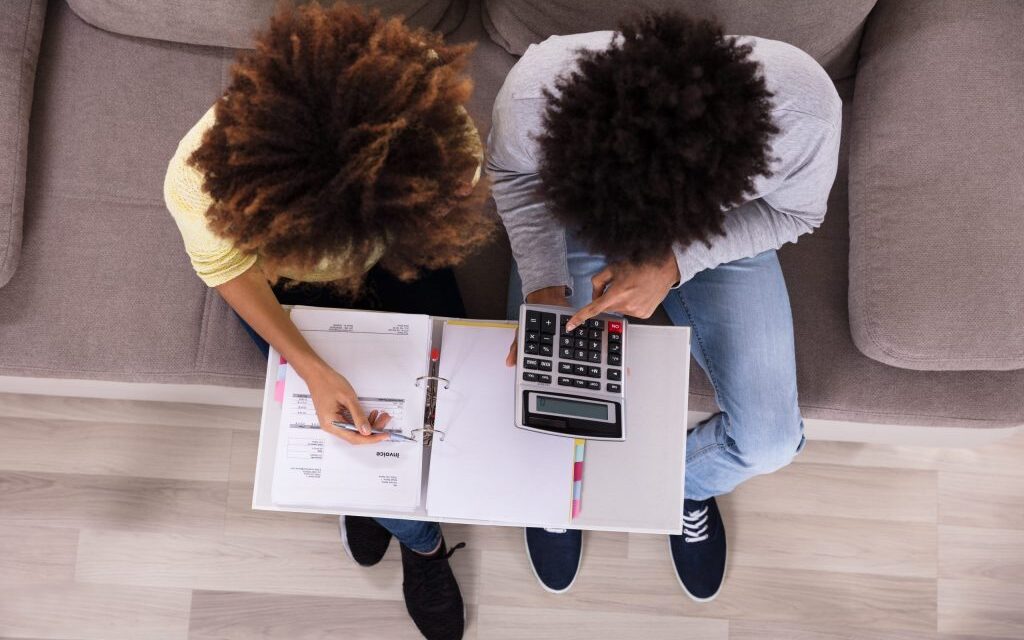

Photo: Andriy Popov via 123RF

Budgeting with your partner promotes a shared understanding of money management, priorities, and values, reducing conflicts and misunderstandings. It provides a roadmap for achieving common financial objectives together. A well-managed budget allows you to live within your means, be prepared for unexpected emergencies, and enjoy life more fully without money worries.

Consequences of Financial Stress on Couples

On the other hand, not working together on budgeting can lead to conflicts and negative consequences that may strain your relationship and hinder your financial well-being. Without systems, it’s easier to avoid taking responsibility for financial decisions. This lack of accountability can lead to poor financial choices, debt accumulation, inadequate preparation for emergencies, and lack of progress toward financial goals.

The Examining the Relationship Between Financial Issues and Divorce report found that financial disagreements are stronger predictors of divorce than other common marital disagreements. Don’t let financial issues affect your relationship’s overall health and happiness. Take the fundamental step of budgeting together to build a solid financial foundation and a harmonious partnership.

Tips for Budgeting with Your Partner

Here are some essential aspects to consider when budgeting together

Open, Honest, and Positive Communication

Talking about money is often stressful and brings up feelings of insecurity, self-doubt, resentment, and fear. Work to create a supportive and understanding environment rather than one of judgment and shame. Be transparent about your financial situation, debts, income, priorities, and concerns. Acknowledge past mistakes and assure each other that you are committed to working together to achieve your goals.

Set Shared Goals

Define short and long-term financial goals together, such as saving for a vacation, buying a home, paying off debt, or building an emergency fund. Shared goals help you stay motivated and focused.

Define Roles and Responsibilities

Decide who will be responsible for specific aspects of budgeting, such as tracking expenses, paying bills, and managing investments. Clear roles can prevent misunderstandings and ensure accountability.

Create a Realistic Budget

Develop a budget that reflects your combined income and accounts for essential expenses like housing, utilities, and groceries. Leave room for discretionary spending and entertainment while still saving and investing. Prioritize building an emergency fund to cover unexpected expenses as a financial safety net to help you avoid going into debt during emergencies.

Photo: Andriy Popov via 123RF

Regular Check-Ins

Schedule regular budget meetings to review your financial progress and address any concerns or changes in circumstances. Make it fun by pairing the discussion with a nice meal or a date night. Celebrate financial achievements. Recognizing your progress can boost morale and motivation to stick to your budget.

Remember that successful budgeting requires teamwork, communication, and dedication. Budgeting apps are a helpful tool when revisiting and refining your budget to remain aligned with your evolving goals and circumstances as a couple. Here’s a list of some top-rated apps for couples:

- YNAB (You Need A Budget). YNAB is a popular budgeting app for zero-based budgeting, helping couples allocate their money to various categories and track spending in real-time. They have a section on their website dedicated to helping couples budget together.

- EveryDollar. Developed by Dave Ramsey, EveryDollar is a budgeting app with premium features such as paycheck planning, goal setting, and a financial roadmap.

- Honeydue. Honeydue is designed specifically for couples, enabling them to see all their accounts, bills, and financial goals in one place.

- Goodbudget. Goodbudget uses the envelope budgeting method allowing couples to share and sync their budgets for specific categories, such as bills, eating out, and vacations.

- PocketGuard. PocketGuard offers real-time budget tracking, bill reminders, debt repayment plans, and spending insights, helping couples stay on top of their finances while being aware of their financial habits.

- Qube Money. Qube Money utilizes a digital version of the envelope system, allowing couples to allocate money to unlimited spending categories, receive partner spending alerts, and track their expenses together.

Before choosing an app, evaluate your specific needs, preferences, and financial goals. There are several key features to consider including:

- Multi-User Support

- Income and Expense Tracking

- Budget Categories

- Real-Time Syncing

- Goal Setting

- Reports and Analytics

- Bill Reminders and Alerts

Always read recent reviews and thoroughly research to ensure the chosen app meets your requirements and is secure to use. Many apps offer a free trial, so try out a few to see which aligns best with your financial goals and feature requirements.

Budgeting with your partner is a foundational aspect of a healthy relationship. It promotes financial harmony, shared goals, effective communication, and a solid framework for managing your resources and working toward a prosperous future together. Selecting and utilizing a budgeting app is a valuable tool for mastering your money habits as a team.

SPONSORED BY JPMORGAN CHASE

Learn more about JPMorgan Chase

The post The Top-Rated Apps for Couples to Budget Together appeared first on AFRO American Newspapers .