Mortgage Interest Rates are at their highest level in the last 20+ years. This has had a chilling effect on the housing market. But despite the higher rates, the market remains strong and more favorable to sellers than buyers. Why?

Low Inventory

Homeowners who took advantage of the previous years’ lower interest rates are very reluctant to sell and buy in this higher interest rate environment. Those lower rates are known as the Golden Handcuffs. There are very few resales. New home developers are not building as many homes. They are in no rush to add inventory.

A Strong Local and National Economy

The jobs report from September 1, 2023, states that unemployment is less than 4% for the 19th month in a row.1

What should a buyer do? If you are just beginning your home buying journey or considering coming back in after a break, here are the steps and what to expect:

- Determine your budget and how much you can afford to pay each month. Factor in any expected income changes in the near future. Be willing to stretch slightly but ask yourself how you would meet your obligations if your income changed dramatically.

- Check your credit and improve it if necessary. Buyers can see a complete report at www.annualcreditreport.com but without a score. Work on removing incorrect or erroneous info. Also look at what debts you can eliminate or reduce.

- Save for and strategize how to cover the down payment, closing costs and other home buying expenses like inspections, moving, and decorating. Downpayment assistance programs (also referred to as “DAPs”), gifts and seller credits can help with these costs. A recent study by Redfin estimates that 40% of homebuyers under 30 are getting a financial gift to help purchase from family members.2 Do not be afraid to ask for help. You might be pleasantly surprised by the answer.

- Research neighborhoods and areas where you want to live. Attend open houses. Drive around areas at various times of the day. Check out the shops, restaurants and services close by.

- Decide on the type of property (cooperative units (also called “housing cooperatives” or ”co-ops”), condominiums, townhome, single-family home) and your must-have features. Condominiums were once the starter home of choice but given the rise in monthly Condo/HOA Fees more clients are choosing townhomes and single-family homes.

- Talk with a Mortgage professional to determine how much financing you are eligible for and if the company/bank offers any special programs to assist. Make sure you align what you can afford with the purchase price. Request a pre-qualification letter and cost estimate of what to expect.

- Find a Real Estate agent who can assist you in finding homes that meet your criteria. Talk with several agents and choose the one who works for you. Key attributes are experience, negotiations skills, neighborhood knowledge, professionalism, and tenacity. A good agent could save you thousands of dollars and a bad one can do the opposite. This is not the time to give a friend or cousin a chance that is new to the business. They can represent you on the next purchase after you both have some seasoning.

- Create a list of potential properties to see with your agent and tour them. Ask your agent if they are aware of any upcoming off market properties that meet your criteria. Use online tools to also find properties. There are several great websites to use like www.Redfin.com and www.realtor.com.

- Submit an offer on your dream home and negotiate the terms with the help of your agent. This is where a good agent can have a significant impact.

- Once you have come to terms with the seller, get the home inspected and appraised while working closely with your lender to finalize the financing. Contracts are generally good for 30 days. It is crucial that you follow your lenders instructions and document requests to meet the contract timelines.

- Go to Closing and Get your Keys.

Even though the market is challenging for buyers, there is some good news. Sellers are much more willing to negotiate than in the COVID market of 2020-2021. Buyers also do not need to waive all contingencies to compete. Seller closing cost help is also available. The seller flexibility combined with the abundance of downpayment assistance programs offered by banks and local governments is making a difference. At George Mason Mortgage, we have provided almost $8 million in downpayment assistance grants to help 800 families in the DC Region become homeowners over the last 18 months.

The bottom line is buyers should not let the current rates scare them out of the market. Stay engaged because given the strength of the economy and low inventory, the market will be more competitive when interest rates drop. For questions contact me at 202-494-3284 or samorris@gmmllc.com.

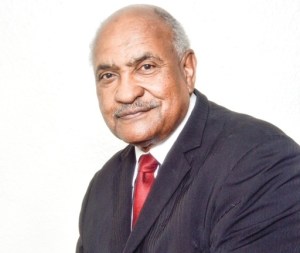

Stephen A. Morris

SVP, Director Community Lending | NMLS ID: 459546

O: (240) 268-1864

M: (202) 494-3284

F: (703) 653-8103

700 King Farm Blvd | Suite 620 | Rockville, MD 20850

samorris@gmmllc.com

www.gmmllc.com/stephen-morris

The post Mortgage Rates Are Up – Now What? appeared first on AFRO American Newspapers .