While Outlining Plans for Equitable Reform, City Will Purchase Liens of Owner-Occupied Tax Sale Properties

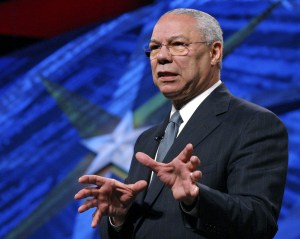

BALTIMORE, MD. (Thursday, September 23, 2021) – Following up on his May action to remove new owner-occupied property liens from the tax sale, Mayor Brandon M. Scott announced the City’s short- and long-term strategy for reforming Baltimore’s tax lien certificate sale process, with a focus on providing relief to homeowners facing liens on their properties.

The Mayor established a Tax Sale Work Group to pursue long-term fixes and announced plans to purchase the liens of 454 owner-occupied homes this fall, in line with the Mayor’s desire to protect Baltimore’s legacy residents. This purchase will satisfy the standing liens on these properties, taking them out of the tax sale process and allowing homeowners to start fresh with a clean slate.

“We know that tax sale currently does not operate in a way that is fair to our city’s low-income homeowners,” said Mayor Brandon M. Scott. “I look forward to working closely with the Tax Sale Work Group to build a more equitable process, while also taking steps now to provide needed relief to our most vulnerable homeowners.”

Funds for the purchase will come from a combination of Baltimore City general funds and federal grants. This will be an interim measure while the Tax Sale Work Group works towards comprehensive reform.

The Mayor was joined for the announcement by City Administrator Christopher Shorter, Council President Nick Mosby, Councilwoman Odette Ramos (D-14), City government officials, and housing advocates.

The Tax Sale Work Group will be made up of housing advocates, legal aid professionals, and tax sale experts, focused on comprehensive reform of the tax sale process. Chaired by Deputy Chief Administrative Officer Daniel Ramos and Daniel Ellis, Executive Director of Neighborhood Housing Services of Baltimore, the Work Group will identify current gaps in the system and ways to make the process more equitable. The group will also work with state legislators to get Baltimore City more local authority over the process and advise on technological updates that would allow for payment plans. The membership is as follows:

Daniel Ellis – Neighborhood Housing Services (NHS) of Baltimore – Co-Chair

Daniel Ramos – Deputy City Administrator – Co-Chair

Owen Davis – St. Ambrose Housing Aid Center

Margaret K. Henn, Esq. – Maryland Volunteer Lawyers Service (MVLS)

Heidi Kenny – Kenny Law Group, LLC

Nneka Nnamdi – Fight Blight Bmore

Shana Roth-Gormley – Community Law Center

Claudia Wilson Randall – Community Development Network of Maryland

Representative – Baltimore City Information Technology

Representative – Department of Finance

Representative – Department of Housing and Community Development

Representative – Department of Public Works

Today’s announcement comes following the Mayor’s decision in May to remove first-time owner-occupied liens from the annual tax sale. At the time, Mayor Scott said he would take additional steps to address the tax sale process.

The Work Group will have its first meeting later this fall. Meetings are open to the public and can be found on the Boards and Commissions webpage: mayor.baltimorecity.gov/bc.

Help us Continue to tell OUR Story and join the AFRO family as a member – subscribers are now members! Join here!

The post Mayor Announces Plan to Comprehensively Reform Tax Sale Process appeared first on AFRO American Newspapers .