By Chris Katje

The sports betting world was shocked in August when PENN Entertainment (NASDAQ: PENN) announced a licensing deal with The Walt Disney Company (NYSE: DIS) to launch ESPN Bet in the fall.

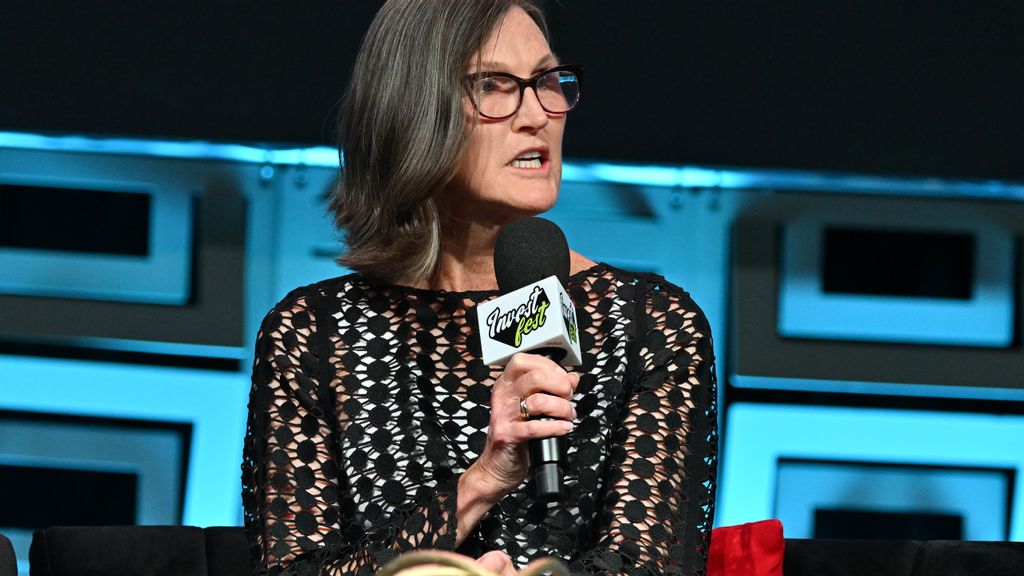

In an exclusive interview on “The Raz Report,” Ark Invest CEO and founder Wood discussed her views on DraftKings’ upcoming launch of ESPN Bet this fall.

“We will be watching the share gains carefully,” she said.

Wood added that she doesn’t believe the ESPN Bet sportsbook can take meaningful market share from DraftKings or from FanDuel, a platform owned by Flutter Entertainment (OTC: PDYPY).

“We’re very pleased with what DraftKings has done over the last couple years.”

DraftKings faced a lot of competition previously and has recently gotten away from heavy advertising, Wood said. She also acknowledged DraftKings’ diversification into areas like non-fungible tokens.

“Our analyst Nick Grous think DraftKings is in the pole position, along with FanDuel of course.”

Penn Entertainment will pay Disney $1.5 billion in cash plus additional warrants over 10 years to ESPN for the rights to license the ESPN brand.

The company’s Barstool Sportsbook will be rebranded to ESPN Bet in the fall, with Penn also announcing it had sold the Barstool Sports brand back to Dave Portnoy.

Ark Invest holds a stake in DraftKings and is optimistic about the future expansion of sports betting. According to its Big Ideas 2023 report, Ark forecast 27% annual growth in sports betting over the coming five years.

The comments from Wood follow a recent post by Ark Invest research associate Andrew Kim, who brushed off the competition against market leaders DraftKings and FanDuel.

“Despite Barstool’s eminence as a standalone media company, Penn’s Barstool Sportsbook failed to capture meaningful market share in U.S. sports betting, as measured by share of consumer deposits,” Kim said.

He added that Barstool Sportsbook had a market share of 4% in June 2023, compared to 34% and 30% for DraftKings and FanDuel, respectively.

“If Penn could not win market share with Barstool, how will it fare with ESPN, a legacy media propriety battling a multi-year decline in market share?” Kim noted.

ESPN has seen its cable subscribers decline from its peak of 100 million in 2010 to around 71 million today, he said. “While no company has been able to penetrate the DraftKings-FanDuel duopoly, could ESPN Bet be the first? We would be surprised.”

DraftKings ranks among the top 10 holdings in two of Ark Invest’s ETFs, highlighting its significance in the firm’s portfolio.

The sports betting stock is the tenth-largest position in the Ark Next Generation Internet ETF (NYSE: ARKW), representing $61 million and 4.5% of assets.

DraftKings is the fourth-largest position in the Ark Fintech Innovation ETF (NYSE: ARKF), representing $62.4 million and 7% of assets.

The other sports betting stock owned by Ark Invest is Genius Sports (NYSE: GENI), which provides data from sports events to sports betting operators and sports media companies.

Genius Sports is the 16th largest position in the Ark Next Generation Internet ETF, representing $32.4 million and 2.4% of assets.

DKNG, PENN Price Action: DraftKings shares were trading 2.12% higher Thursday at $30.30 versus a 52-week trading range of $10.69 to $34.49. Shares of the sports betting company are up 174% year-to-date.

Penn Entertainment shares were trading down 1.06% at $23.82 versus a 52-week trading range of $22.34 to $39.35. Shares of Penn are down 18% year-to-date.

Produced in association with Benzinga