By Tashi McQueen,

AFRO Political Writer,

tmcqueen@afro.com

When considering the future of Black wealth, Black owned banks are considered to be a viable means of support for business owners and families alike.

“One of the things you look for in a bank is not only to help you have somewhere to put your money, but you want to have somewhere where you get money to grow,” said Andrea Scott, Baltimore-based owner of Brownstone Tax and Financial Services.

Black financial institutions are gaining in popularity these days for a number of reasons.

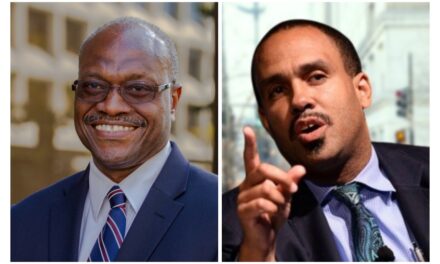

“Too often people are feeling invisible or unwelcome going into a traditional bank. When folks come into the Black-owned bank, there’s a comfort level knowing that you are talking to folks from your neighborhood and a similar experience,” said William Martin, executive vice president of Columbia Savings and Loan Association. “When you put your money in a bank you have to think, is it working in your neighborhood or is your money being put to work somewhere else for someone else?”

There are 147 minority-owned financial institutions in the U.S. according to the Federal Deposit Insurance Corporation.

The following are just a few of the Black banks across the U.S.:

The Harbor Bank has eight branch locations throughout the Maryland, D.C. and Northern Virginia area. They also have a loan office in Silver Spring, Md. When the Harbor Bank of Maryland opened in September 1982, it had $2.1 million worth of assets. In 2020, it had $321 million in assets.

According to prior AFRO reporting by Megan Sayles, Harbor Bank is one of the only Black banks owned in Maryland. They offer checking, savings, “time deposits,” debit cards, credit cards, commercial real estate, personal, home improvement and many forms of loans.

At HOPE Credit Union (HOPE) deposits are used to address deep south socio-economic struggles through empowerment and low-cost financial resources, according to their website. Bankers’ deposits are insured up to $250,000 with a guaranteed return on your funds. HOPE is based in Alabama, Arkansas, Louisiana, Mississippi and Tennessee.

“All of the work that we do is aligned with our mission,” said Holly Cooper, senior vice president of marketing and communications for Enterprise Corporation, HOPE Credit Union and HOPE Policy Institute.

HOPE supports minority-owned businesses by giving commercial loans. According to their website in 2021, HOPE gave 2,630 commercial loans amounting to $85 million in 2021. Around 71 percent of those loans were for minority-owned or led businesses. About 46 percent of their members were “unbanked or underbanked” before them.

Columbia Savings and Loan Services Association

The Columbia Savings and Loan Services Association, created in 1924, offers mortgages, church loans, Certificate Deposits and Individual Retirement Accounts. They are based in Milwaukee and are the only Black bank in the state.

“From the very beginning, the mission of this financial institution has been to make sure that Black and Brown folks can get access to capital,” said William Martin, executive vice president of Columbia Savings and Loan Association. “One of the major things that this bank offers in addition to savings products, is the ability to access credit in terms of homeownership. What we’ve done is to work with a number of low- to moderate-income families.”

Martin said they help families realize where they can cut back to ensure they can buy a home and how important equity can be.

OneUnited Bank is the first Black digital bank in the country. It has offices in Los Angeles, Boston and Miami. There is an option to send payments from person to person with their mobile banking app.

“As the largest Black-owned bank in the nation, our number one mission at OneUnited Bank is to make financial literacy a core and commonplace value in the Black community,” said Kevin Cohee, owner and CEO of OneUnitedBank. “Everything we do is designed to move our community forward with financial and banking literacy in the journey towards generational wealth. We are steadfast supporters of the #BankBlack and #BuyBlack movements, which promote circulation of the $1.4T generated by the Black community.”

In addition to online banking, OneUnited offers the “Black Wall Street Checking” account, “Bank Black Savings” account and a secured credit card service.

“[Using these services] can help build a good ChexSystem record and increase credit scores, which lead to better terms overall for wealth-generating transactions like homeownership and small businesses,” said Cohee.

Carver Federal Savings Bank was founded in 1948 by a group of Black community leaders to uplift Black communities in New York by improving the limited financial options at the time.

Carver has seven branches and 24/7 ATMs situated in low- to moderate-income neighborhoods. Carver offers a multitude of services including banking for students, personal and business checking and savings accounts and non-profit and faith-based loans.

Carver is headquartered in Harlem, N.Y. and has funded around $48 million worth of loans to minority and women-owned businesses enterprises through partnerships such as the Metropolitan Transportation Authority Small Business Mentorship Program. Carver has also supported 16,000 loans to small businesses across the nation.

Tashi McQueen is Report for America Corps Member.

The post Banking Black: a look at some of the Black financial institutions in operation appeared first on AFRO American Newspapers .