By Ramsey Archibald

Sales tax is simply a fact of life in Alabama. Residents here are used to it; everything is nearly 10% more than the advertised price. In many Alabama cities, it’s more than 10%. But in most other states, sales tax isn’t nearly so high.

In fact, when it comes to sales tax at the local level – within cities and counties – Alabama has the highest rates in the nation.

The average sales tax in Alabama cities, towns and counties is 5.25%. The next closest state – Louisiana – has an average local sales tax rate of 5.1%. Those are the only two states where the average local sales tax is above 5%.

That’s according to 2023 data from The Tax Foundation, an independent tax policy nonprofit based in Washington, D.C.

Alabama’s state-level sales tax rate is just 4% – that’s actually among the lowest in the nation. And many other tax rates here are also low, including property tax, for which Alabama ranks 49th out of 50 states and Washington, D.C.

Alabama’s 4% state sales tax rate is tied for the seventh lowest in the nation, but its high average local tax rate means its combined sales tax – or local sales tax plus state sales tax – is 9.25%. That’s the fourth highest combined rate in the nation.

The local sales tax rate calculated by The Tax Foundation is a population-weighted average of cities and counties in each state. Within Alabama, the local tax rate varies widely.

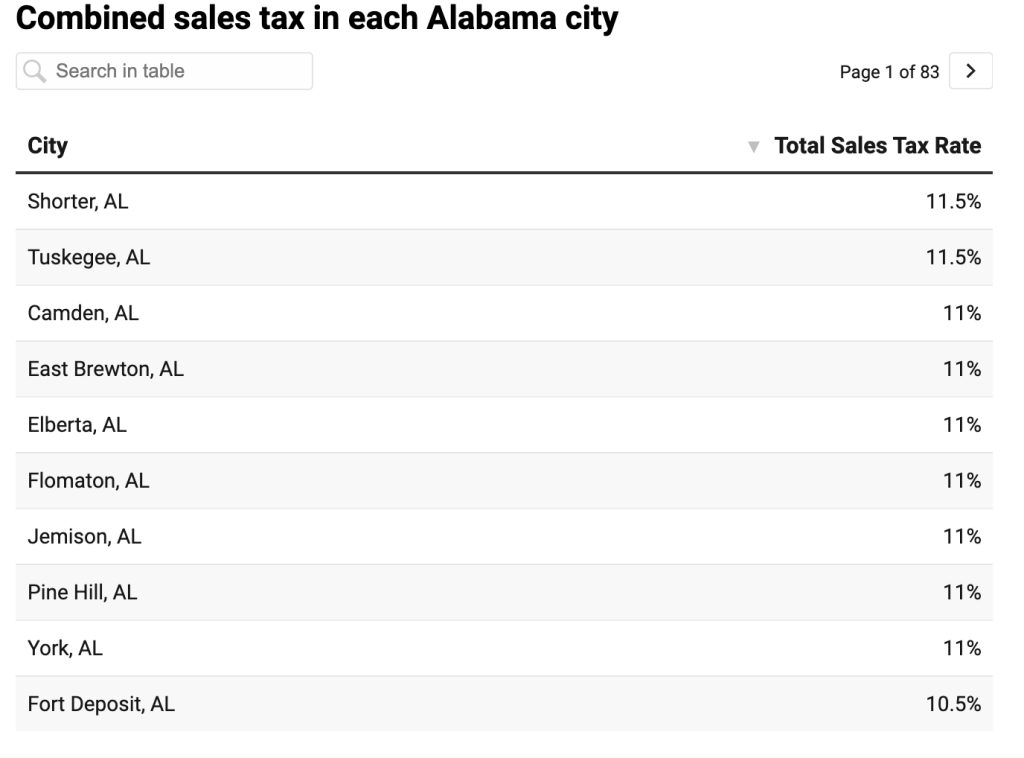

The cities with the highest combined sales tax rates in Alabama are Shorter and Tuskegee, according to data from Sale-Tax.com. The sales tax rates in those two towns are 11.5%.

You can see the full list of combined sales tax rates in each Alabama city from the Sale-Tax.com as of 2023 in the list below.

City-level sales tax data in this story has been updated since first publication to show more accurate data.