By John Sharp

A family of four that spends about $10,000 in groceries this year while shopping in Mobile, Tuscaloosa, Birmingham, and Montgomery, will also be doling out an extra $1,000 in taxes.

The tax is causing an extra pinch in Alabamian’s wallets this year as inflation soars to heights unseen since 1981.

Food prices are about 11% more expensive than they were a year ago. That $5 loaf of bread bought in 2019, now costs approximately 63 cents more.

“No one should have to wonder if they can afford to eat today,” said Chris Sanders, spokesperson with Alabama Arise. “But many Alabamians already were struggling to put food on the table even before the pandemic hit.”

He added, “COVID-19 disrupted the global supply chain and led to worldwide inflation, which made it even harder for families to cover the cost of basic needs.”

In Alabama, where 15% of residents live in poverty, renewed efforts are underway to tackle the state’s 4% sales tax on groceries that critics say affects low-to-moderate households the worst.

Groups like Alabama Arise and the Alabama Policy Institute want to outright eliminate the sales tax on groceries. Other organizations, like the Washington, D.C.-based Tax Foundation, believe Alabama and 11 other states with a sales tax on grocery items consider offering income tax rebates.

For Alabama, the issue is nothing new. The state has been wrestling with the idea of eliminating the sales tax on grocery purchases since at least Bill Clinton’s presidency.

“The efforts in Alabama, as they always have turned out to be, is how do you replace the revenue,” said Sonny Brasfield, executive director with the Association of County Commissions of Alabama.

Replacing revenue

Indeed, the sticky point for the state is finding a way to eliminate the tax without causing lasting harm to public schools.

The state’s 4% sales tax on groceries generates an estimated $500 million annually. Revenues from purchasing food and food ingredients goes directly into the state’s Education Trust Fund, a mammoth $8.2 billion account that finances public education in Alabama.

Alabama Arise estimates about 6% of the fiscal year 2023 EFT budget was derived from grocery sales.

“A lot of people say our educational system is underfunded,” said State Senator Arthur Orr, R-Decatur, chairman of the Senate Finance and Taxation Education Committee. “We should be careful and cautious moving down that road.”

Alabama is one of only three states in the U.S. – Mississippi and South Dakota being the others – that assesses a full sales tax on groceries without offering a tax credit or rebate for low-income households.

Brasfield said the efforts of reform have always hit a roadblock. Chief among the concerns: How do you replace the lost revenue?

But some grocery prices have increased, year-over-year, prompting lawmakers to say they will take a fresh look on the sales tax for groceries.

The prices at the stores have soared. In May, the price for meats, poultry, fish, and eggs jumped up 14.3%, according to Bureau of Labor Statistics. It was the largest 12-month increase since May 1979.

The price of eggs, in fact, rose a whopping 23% within the past 12 months.

Orr said that lawmakers should consider looking at sales tax on groceries but remaining committed toward finding a surefire solution to the loss ETF revenue.

They will have of plenty of time: Alabama lawmakers do not plan to assess its taxes, or address American Rescue Plan Act money the state is receiving this summer and fall, until after the first of the year.

The 2023 spring legislative session does not convene until March – nearly eight months out.

“We should definitely look at it and consider it,” said state Rep. Danny Garrett, R-Trussville, chairman of the House Ways and Means Committee.

Legislation

Alabama Arise, a non-profit and non-partisan organization that advocates for low-income residents, believes it has a solution and they are hoping enough lawmakers will back their pitch next spring.

Legislation, unveiled during the waning days of this past spring’s session, suggested replacing the lost revenue by placing a cap on the deduction for federal income taxes paid that Alabama taxpayers use to reduce their state income taxes.

The deduction, under the plan, would be capped at $4,000 for individual taxpayers and $8,000 for couples. The proposals, introduced in the Alabama House and Senate last year, are constitutional amendments that require voter approval.

Alabama Arise believes that repealing the tax on groceries and capping the deduction would result in a net tax savings for all but the top 5% of earners in Alabama, or those who make more than $311,000 a year.

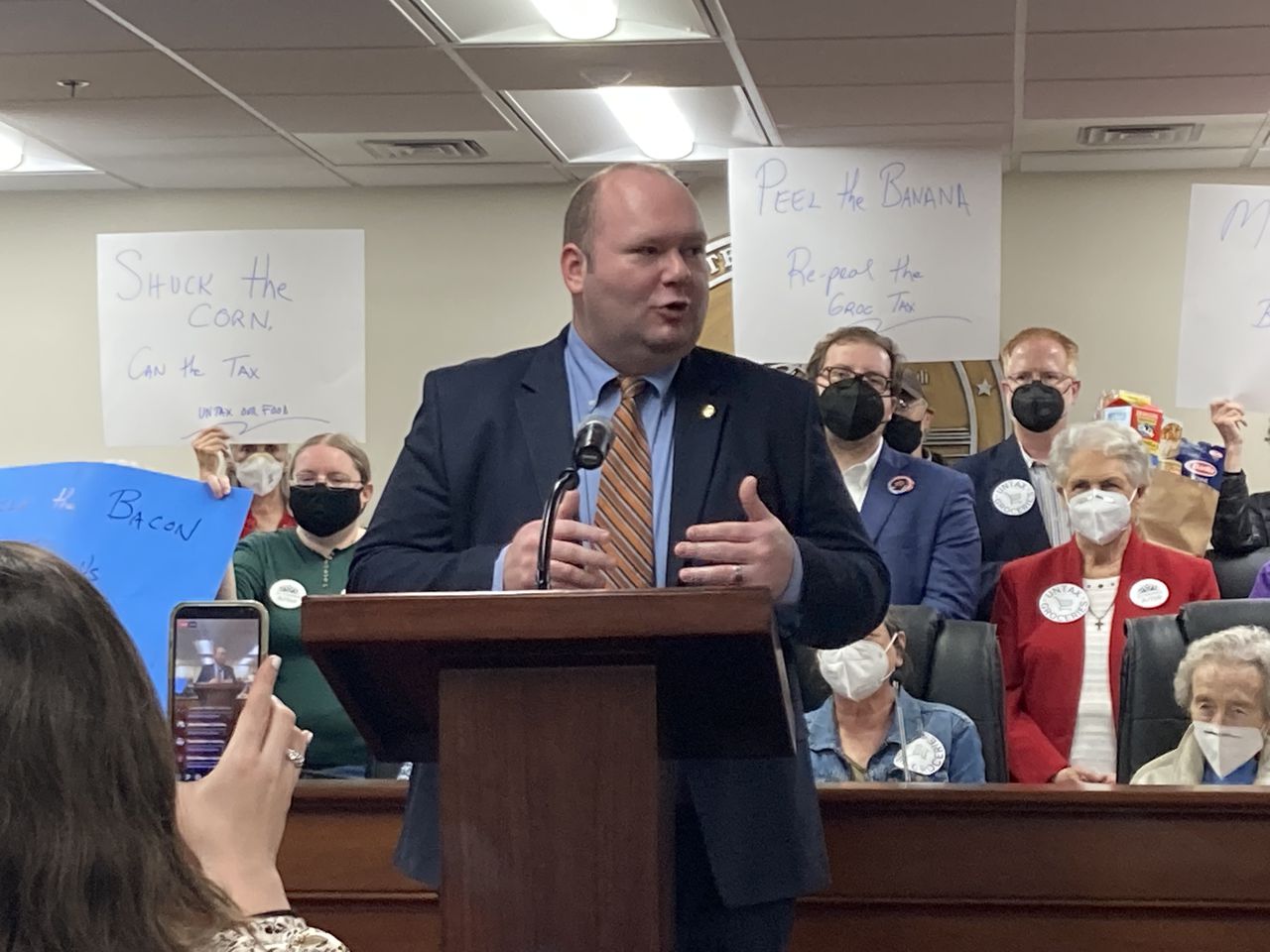

The legislation has bipartisan backing, but it did not get a hearing before state lawmakers adjourned their annual session.

The legislation did, however, get some attention as it was the focus of a media rally at the State Capitol. Attendees gathered to show support for the measure as they held handmade signs that read, “Let Go the Grapes. Untax our food!” and “Sizzle the Bacon. Don’t fry us with the groc tax!”

Alabama Arise also commissioned a poll and released its findings in March that showed nearly 60% support for removing the state sales tax on groceries as long as there was not a cut in education funding. Of those supporters, 56.1% were Republican voters.

“Eliminating this cruel tax on survival would save families the equivalent of two weeks’ worth of groceries every year,” said Sanders. “And by reining in a tax giveaway for wealthy people, lawmakers can untax groceries without cutting even a dime of funding on our public schools.”

Complicated questions

Two states – Kansas and Virginia – authorized removing their sales tax on groceries, which means only 11 states will soon remain with a sales tax assessed on groceries.

In Kansas, the state’s 6.5% sales tax on groceries will be gradually eliminated over the next three years through a campaign called “Axe the food tax.” Local sales taxes on food will still apply. Virginia’s 1.5% sales tax on food and personal hygiene will be eliminated on New Year’s Day.

Haley Kottler, campaign director with Kansas Appleseed Center for Law and Justice, said that eliminating taxes “is important to reducing food insecurity.” Studies show that that assessing taxes on groceries increases the likelihood of household food insecurity.

“Hundreds in yearly food savings will help Kansans and their families make ends meet,” said Kottler. She said the savings can go toward paying housing, medical care, or for educational opportunities.

Lisse Regehr, president and CEO with Thrive Allen County – an Iola, Kansas-based non-profit that advocates for rural communities and development – said the measure had bipartisan support and as a “long-overdue step” for the state.

But in Alabama, lawmakers say they are concerned that eliminating the states sales tax rate does not guarantee there will be a corresponding tax reduction by local and county sales taxes. And in Alabama, the sales tax is the top revenue source for funding local governments.

“Could we get rid of the municipality tax, or could we restrict them from adding it on?” said Senator Greg Albritton, R-Atmore, chairman of the Senate Finance and Taxation General Fund Committee. “If we move the state (sales tax) what would stop the cities and counties from taking it on for their benefit?”

Brasfield, with the ACCA, said previous legislation has made it clear that local entities cannot levy a “replacement tax” on food. He said that his organization has been “fully supportive of that” and has assisted in crafting legislation to ensure the state’s sales tax on groceries – if eliminated – “could not be backdoored by the local governments.”

Brasfield said one question remains: What constitutes groceries?

“I don’t think the bills have moved far enough through the process for that to be settled (in Alabama),” he said.

According to the Tax Foundation, it can be a complicated and cumbersome process. For instance, among the states with full or partial exemption of sales taxes on groceries, 62% of them exclude candy and soda. That means those items are assessed a sales tax.

South Carolina, for instance, exempts “unprepared food” that can be lawfully purchased by those who participate in the Supplemental Nutrition Assistance Program (SNAP) through the federal government.

Rebates, holidays, and suspensions

Another question could also loom: Does eliminating the sales tax on groceries provide the most benefit for low-income taxpayers?

The Tax Foundation does not think so. The independent tax policy organization, in a study released in April, argues that a one-time credit of $75, for instance, would provide a 31% savings for low-income households on their tax liability.

“We found that if you want to give relief to lower income folks, taking away the sales tax on groceries is not the way you do that,” said Janelle Fritts, policy analyst at the Tax Foundation. She noted that purchases made by those eligible for the SNAP program are already exempt from paying sales taxes.

“We found that if you bring down the sales tax overall, and then give a dedicated grocery tax rebate to the folks you want to help, that will help them in the long run,” she said.

Oklahoma, for instance, offers a so-called “grocery tax credit,” that is an income tax credit offered in that state since 1990. Eligible households – those with incomes at or below $50,000 per year for filers who are elderly, have a physical disability or claim a dependent; and $20,000 per year for everyone else – can get a $40 rebate, according to the Oklahoma Policy Institute.

The credit was claimed by 385,362 households in 2018, costing approximately $31.2 million.

Another idea that has also has some support: A grocery tax holiday.

Alabama State House Minority Leader Anthony Daniels, D-Huntsville, said he would like to see the sales tax on groceries be given a temporary “holiday,” similar to what the state has in place each summer during a weekend “Back to School” sales tax holiday.

In Tennessee, the state’s 4% sales tax on groceries will be suspended during the month of August. The holiday is expected to cost $80 million. Local taxes, ranging between 2.25% to 2.75% are also exempt on food and food ingredients during the tax holiday. Local governments will be “held harmless” for their portion and reimbursed by the state for lost revenues, according to Kelly Cortesi, spokesperson with the Tennessee Department of Revenue.

Another approach could be a temporary suspension of all or parts of the sales tax on groceries.

That approach is being done in Illinois, where lawmakers suspended 1% sales tax on groceries for the entire fiscal year that began on July 1. The move is expected to result in about $400 million in savings.

Chris Mooney, a political science professor at the University of Illinois at Chicago, said the tax suspension comes at a time when the state, long ravaged by horrible state budgets, has improved its fiscal standing.

But Mooney said the move is not overly impactful as it’s more of a political boon for Democratic Gov. J.B. Pritzker, who could be weighing a future presidential run.

“There are different ways to look at it from different sides,” said Mooney. “One message is, ‘I am Governor Pritzker, and I care, and I feel your pain and I’m trying to help.’ The one message Republicans will say is that ‘I am the governor and I want to be president and here’s $50 to vote for me in the fall.’”

But in Alabama, those are not issues concerning Sanders and Alabama Arise. Their focus is on getting enough lawmakers to support the outright elimination of the sales tax on groceries and get the matter to the votes.

“Ending the state grocery tax would help families make ends meet and make life better for people across Alabama,” he said.