By Megan Sayles

AFRO Business Writer

msayles@afro.com

In January, the Federal Trade Commission (FTC) delivered an opinion and final order prohibiting Intuit, parent company to TurboTax, from advertising its services as “free” unless they are free to all customers, or if stipulations are clearly communicated. The directive came after an investigation into deceptive advertising claims against the global financial technology company.

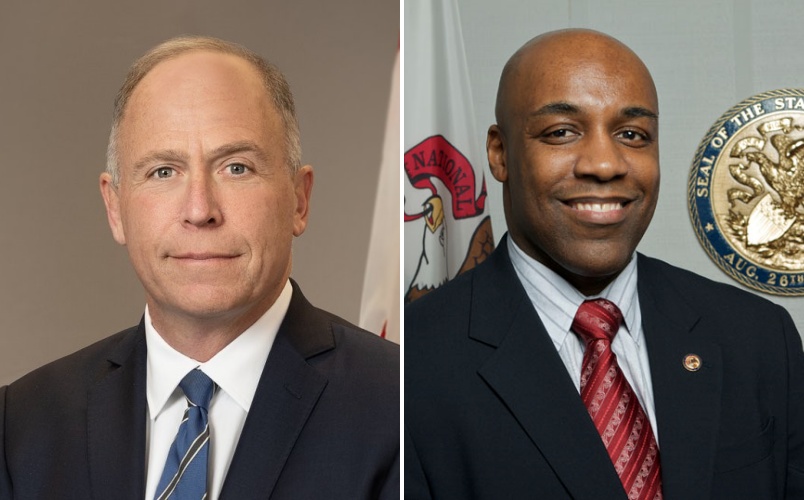

Intuit has since appealed the FTC ruling in the U.S. Court of Appeals for the Fifth Circuit. In response, D.C. Attorney General Brian L. Schwalb and Illinois Attorney General Kwame Raoul, alongside 22 state attorneys general, filed a brief calling for the appeal to be rejected on June 24.

“Intuit misled taxpayers in D.C. and across the country with ads falsely claiming TurboTax was free,” said Schwalb in a statement. “Preying upon low-income taxpayers and military families who were eligible to file their taxes at no cost, Intuit pocketed millions of dollars in profit. The FTC’s cease and desist order protects consumers from this type of unacceptable, illegal conduct.”

Intuit previously settled with a coalition of 50 states and D.C. in 2022, resolving state probes into allegations that the company misled consumers about TurboTax’s services. The agreement included $141 million for Americans who paid to file their taxes on TurboTax when the software should have been free. Nearly 4.4 million customers across the country received a payment, according to Intuit.

A few months before the January opinion and final order, the FTC’s Chief Administrative Law Judge D. Michael Chappell ruled that Intuit participated in deceptive advertising. He ordered a cease and desist on these alleged practices.

Representatives from Intuit have concerns surrounding the objectivity of the judgment, particularly because it was the FTC that lodged the suit and a judge employed by the agency who issued the ruling.

“We resolved the core of the FTC’s complaint against us more than two years ago with the settlement with all of the state attorneys general,” said Derrick Plummer, a spokesperson for Intuit. “The FTC’s five-year escapade against us is an overreach and waste of taxpayer dollars. Intuit has always been clear and fair with our customers.”

“We have appealed the FTC’s unconstitutional order to the federal appellate court and are confident that when our case is heard, we will win,” he continued.

Attorneys general from Maryland, Maine, Arizona, California, Colorado, Connecticut, Delaware, Hawaii, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Washington and Wisconsin joined Schwalb and Raoul in filing the June brief.

The officials urged the court to side with the FTC’s opinion.

“Intuit’s arguments in this appeal— which attempt to invalidate the commission’s opinion by claiming that it was not supported by substantial evidence and that the relief the commission ordered was unnecessary given the states’ settlement— would, if adopted, interfere with the states’ interests in preventing deceptive advertising,” wrote the attorneys general in the brief.

The post D.C. AG calls for continuance of FTC ban on ‘deceptive’ TurboTax ads appeared first on AFRO American Newspapers.